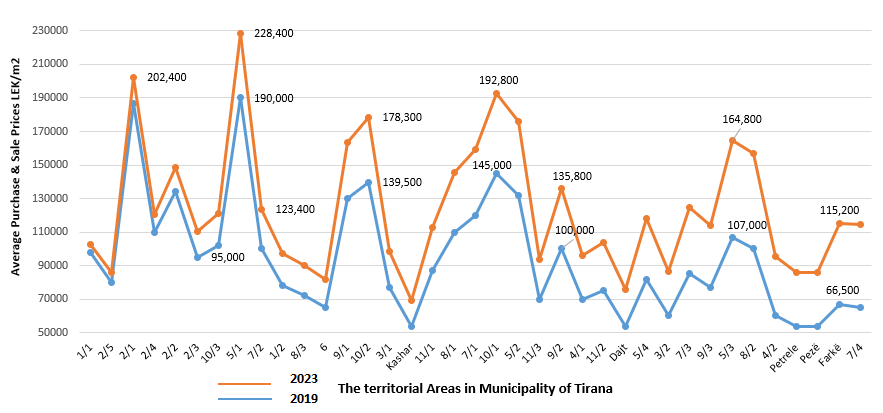

According to decision no. 457 dated 26.07.2023, “For some changes in the Methodology of Determining the Taxable Value of Real Estate “Building”, of the Tax base for Specific Categories, the nature and Priority of Information and Data for the determination of of the Tax Base, as well as of the Criteria and Rules for the Alternative Assessment of the Tax Obligation as amended”, the average reference prices for the sale and purchase of buildings for residential purposes in Albania have been changed drastically in some of the territory areas, especially for the Municipality of Tirana.

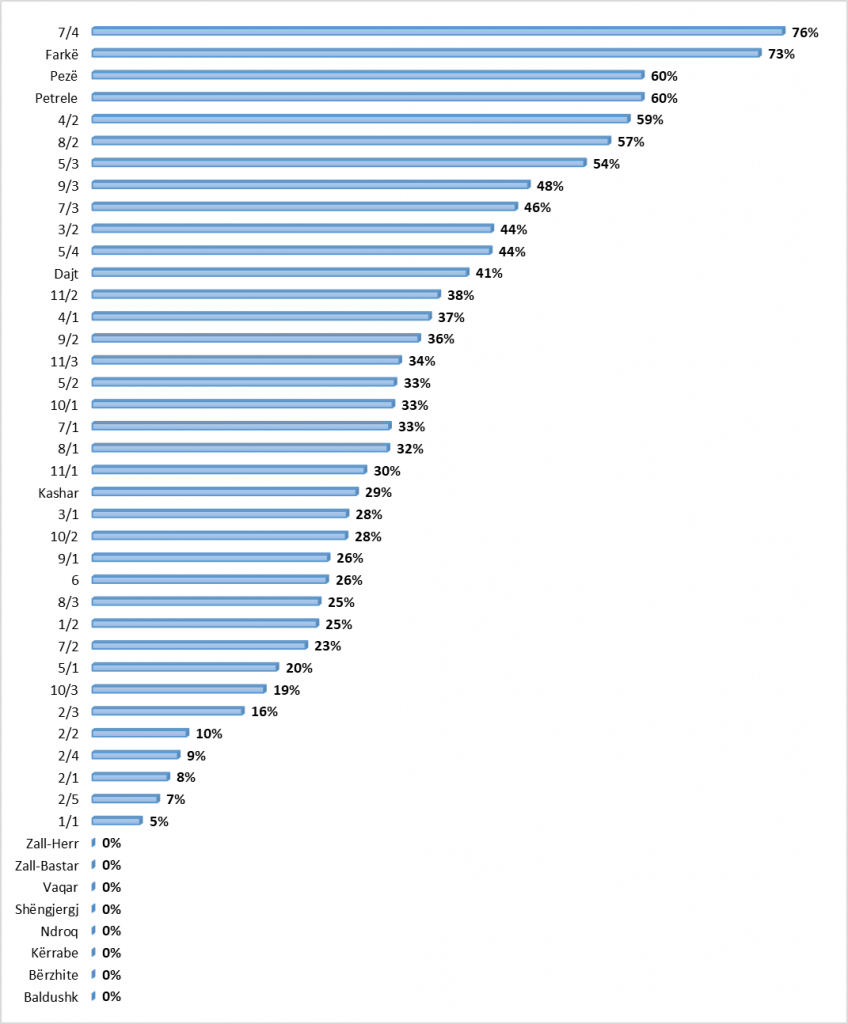

The biggest increase of 76% compared to 2019 was experienced by “area 7/4”, which includes the roads from the “New Ring”, the “Flour Factory”, the former Aviation Field and Yzberisht. This was followed by a very high increase for the Area of Farka (73%), Petrela and Peza (60%) and further according to the following table:

The average reference prices for the sale and purchase of buildings for residential purposes are expressed in Lek/square meter according to the cities in Albania and according to the relevant areas in the Municipality of Tirana, where the most significant changes have occurred.

As a result of the increase in the sale and purchase average prices of buildings, the minimum reference prices for rental contracts of businesses also increases to the same extent, for which, the businesses will have to declare and pay a higher withholding tax for rent, for those cases where they have concluded a rental contract with a price very close to the minimum allowed by law from the previous DCM.

All entities should review the rent contracts and WHT declarations on Rent to check if they are affected by the new reference prices of buildings as per their territorial area.

- AEcO Business Solutions

For more information, please feel free to contact us at [email protected] or subscribe to our website to receive the latest amendments happening in the field of tax and more.